|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

The Comprehensive Guide to Understanding a 30 Year MortgageA 30-year mortgage is one of the most popular options for homebuyers due to its extended term and lower monthly payments compared to shorter-term loans. However, it's crucial to understand both the benefits and drawbacks before committing. Advantages of a 30 Year MortgageLonger repayment period: This allows borrowers to spread their payments over three decades, resulting in lower monthly payments.

Drawbacks of a 30 Year MortgageWhile there are significant advantages, there are also some downsides to consider:

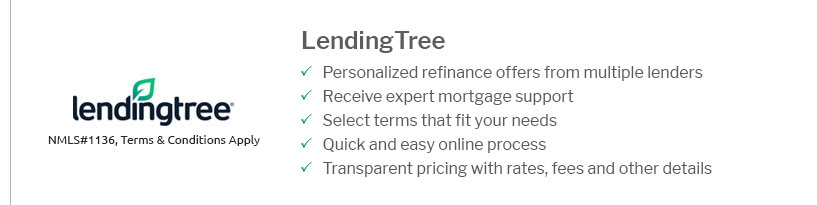

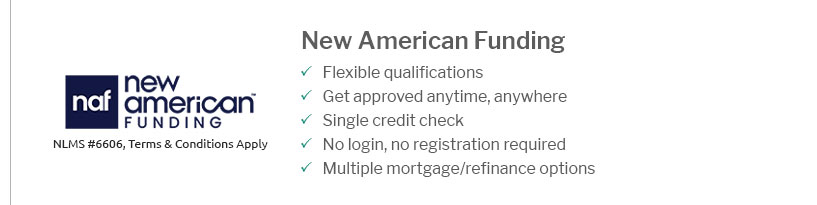

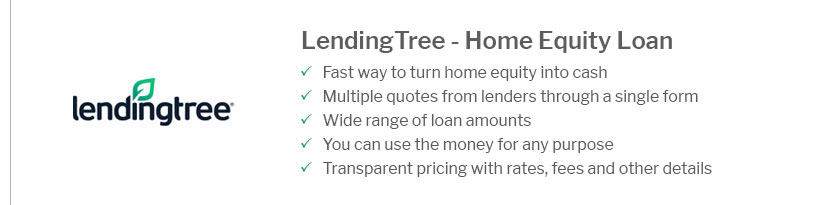

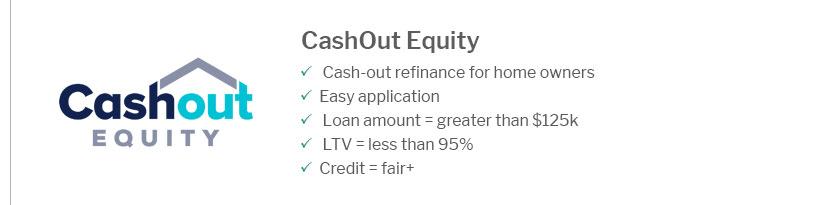

Refinancing OptionsMany homeowners explore refinancing to take advantage of lower interest rates or change their loan terms. Understanding what are refinance interest rates can help you decide if this is a viable option for you. Who Should Consider a 30 Year Mortgage?This type of mortgage is ideal for individuals who:

For first time home buyer financing, a 30-year mortgage can provide a manageable entry point into homeownership. FAQsWhat is the average interest rate for a 30-year mortgage?Interest rates vary based on market conditions and individual creditworthiness, but as of the latest data, rates typically range between 3% and 4%. Can I pay off a 30-year mortgage early?Yes, you can pay off your mortgage early, although it’s important to check for any prepayment penalties in your loan agreement. Is it better to choose a 15-year mortgage over a 30-year mortgage?A 15-year mortgage typically has lower interest rates and helps you build equity faster, but it comes with higher monthly payments. The choice depends on your financial situation and long-term goals. https://apnews.com/article/mortgage-rates-housing-interest-financing-home-loan-88b42783156271f3956c945067e6a565

The average rate fell 6.76% from 6.85% last week, mortgage buyer Freddie Mac said Thursday. A year ago, it averaged 6.94%. Borrowing costs ... https://www.wellsfargo.com/mortgage/rates/

Mortgage interest rates today ; 15-Year Fixed Rate - 5.625% - 5.871% ; 30-Year Fixed-Rate VA - 5.875% - 6.106% ; 30-Year Fixed Rate - 6.625% - 6.780% ; 10/6-Month ARM. https://tradingeconomics.com/united-states/30-year-fixed-rate-mortgage-average-in-the-united-states-percent-w-na-fed-data.html

30-Year Fixed Rate Mortgage Average in the United States2025 Data 2026 Forecast 1971 Historical - 30-Year Fixed Rate Mortgage Average in the United States was ...

|

|---|